We have been following Eventbrite since they are a similar company serving events and having a similar business model of charging for their services only with processing fees since they went public. We are also likely to begin to compete with them more as events discover TicketSignup. We reported on the Eventbrite Q3, Q2 and Q1 earnings this year as well as past public Eventbrite reports, and today we review the Eventbrite 2020 Annual Report.

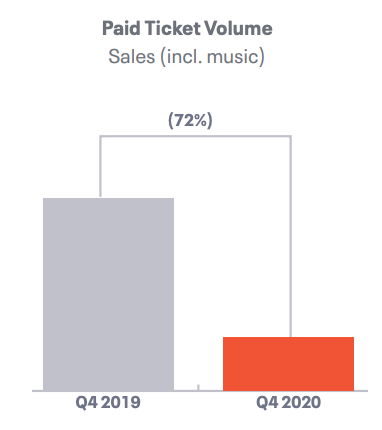

Eventbrite continues to see a significant decline in paid ticket volume of 57% overall for the year. While Q4 volume was up 20% from Q3, it was still below last year.

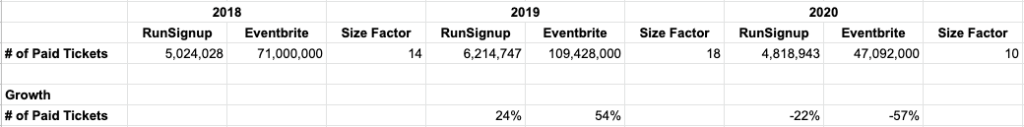

With the yearly report, we are beginning to measure ourselves relative to Eventbrite. As expected from earlier reports, TicketSignup | RunSignup had a lower decline of ticket volume – 22% vs. Eventbrite’s 57%. This was due to two factors. First, virtual events were more of a fit for our customer base. Second, we were picking up some market share in the endurance market as well as in the ticket event market as traditional events like galas and conferences were cancelled and organizations looked for revenue generation ideas like Virtual 5k’s.

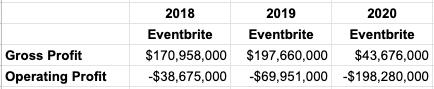

Since TicketSignup | RunSignup is a private company, we do not report our Gross or Operating Profit, but we can say that we were profitable in 2018 and 2019 and with our forgiven PPP loan were only marginally unprofitable in 2020. Eventbrite has been spending a fair amount of money to drive growth, and taking a number of charges in 2020.

Green Shoots

One of the bright spots of the earnings call was the report that Australia, which still has rolling lock downs, has recovered to 87% of the previous year’s ticket volume. They set expectations that the first half of 2021 will continue to be difficult, but if vaccinations remain on pace, they see long term pent up demand for live events.

This compares with what TicketSignup is seeing in February so far (Feb. 1 – Feb. 25) in our US customer base of our transaction and ticket volume recovering to 82% of 2019 totals. We are seeing greater than 60% of that volume from live events. Again, our recovery track of transaction volume is ahead of Eventbrite given our market of mostly outdoor events that have implemented social distance guidelines and is increasingly getting approval for permits for local governments.

Both companies believe their self-serve, scalable platforms will ease the transition of customers as they bring back their events and create new ones.

Eventbrite 2020 Annual Report: Interest Expense

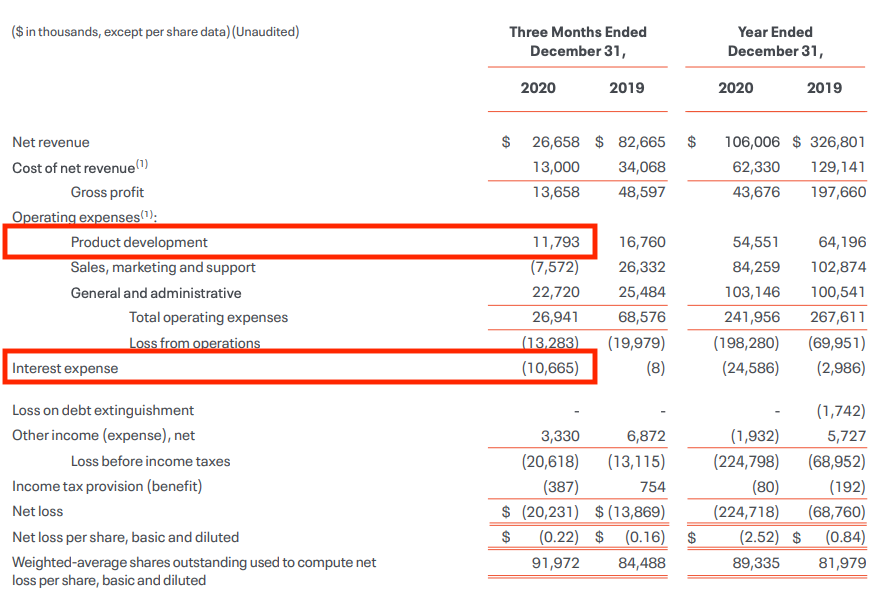

While Eventbrite shored up their balance sheet with two large debt rounds that we discussed in previous quarterly updates, that debt is costing them about the same amount per quarter as they spend on product development:

While Eventbrite shored up their balance sheet with two large debt rounds that we discussed in previous quarterly updates, that debt is costing them about the same amount per quarter as they spend on product development:

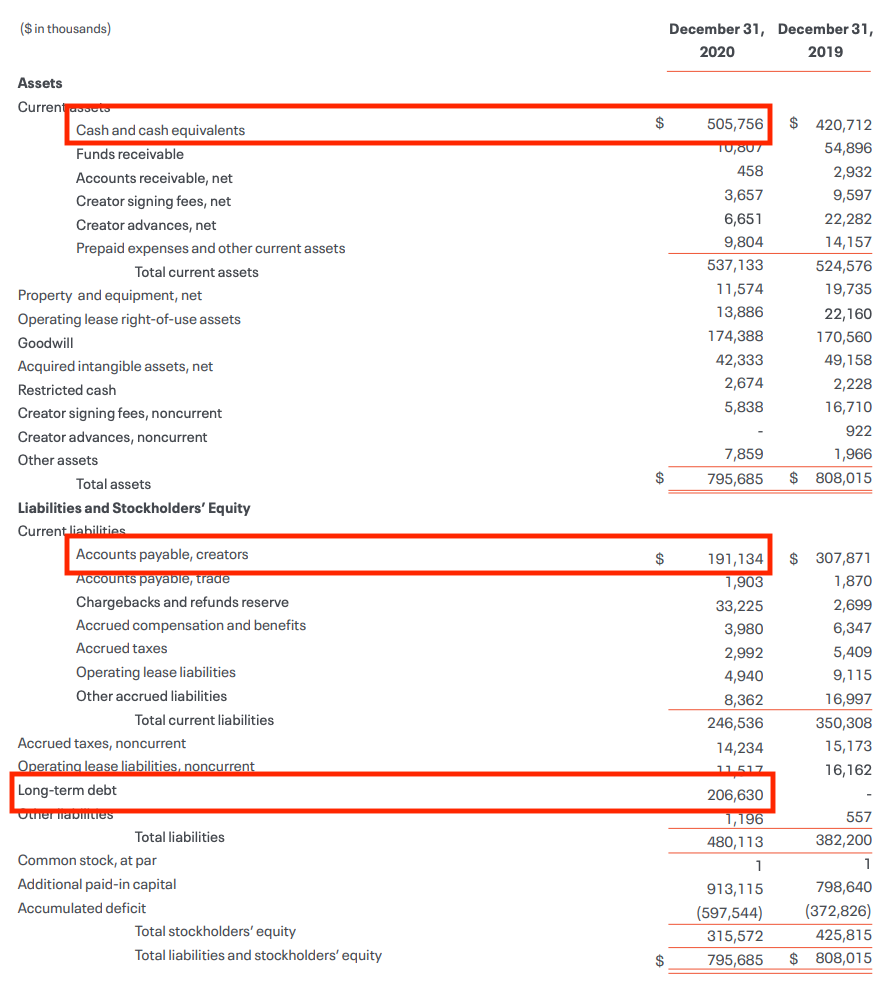

As the live event market comes back and risks decrease, we would expect to see Eventbrite reduce some of the debt they carry. They currently benefit from holding onto $191 Million of event creators funds before payout after those events. This float will probably increase as more live events come back (it was over $300 Million in December, 2019), and can provide the cash cushion they need for operations. This is unlike TicketSignup, where we hold only 5% of customer funds until post event and pay any donations immediately**

** As of 2022, just 2.5% of customer funds are held until post-event.

2022

The Eventbrite 2020 Annual Report demonstrates that Eventbrite should be in a strong position in 2022 as events come back fully. Looking at 2019 as the baseline, they only lost $69 Million. Since they have reduced expenses by about $100 Million, there is a likelihood that they should be profitable if their Gross Profit returns to normal and they pay down some of that interest expense hitting at $10 Million per quarter currently.