Sales Tax and Events

Sales tax obligations for events vary widely depending on state and jurisdiction, with more than 9,000 sales tax jurisdictions in the United States. This can make even knowing what sales tax you owe a challenge.

Since 2019, Marketplace Facilitator Laws have shifted the obligation to collect and remit sales tax from the individual seller (your event) to the platform facilitating the sale (TicketSignup). The good news? TicketSignup makes sales tax easy!

We Calculate Sales Tax

We access sales tax rules from 9,000+ jurisdictions to determine the rate for each purchase.

We Collect Sales Tax

TicketSignup adds sales tax to checkout and collects accurate sales tax charges from each buyer.

We Remit Your Sales Tax

In marketplace states, we file and remit sales tax with all applicable jurisdictions and provide you access to reports.

TicketSignup Takes Care of Sales Tax For You

Get your time back. TicketSignup makes sales tax a snap by taking care of all the obligations for calculating, collecting, and remitting sales tax for ticket events.

We partnered with Avalera as our Sales Tax provider. Avalera has an API we call to get accurate, updated sales tax rates that apply to the specific tickets and items your event sales. For all Marketplace states, TicketSignup then collects and remits sales tax payments to the correct states and jurisdictions.

This means you don’t have to calculate sales tax and you don’t have to file and remit your collected sales tax. And you don’t have risks of incorrect sales tax like on other ticket platforms that just use extra fees.

If you’re audited (or just curious), you can easily export summary and individual transaction reports from your TicketSignup dashboard. Reports show summary and line-item details of the sales tax collected and remitted on behalf of your event.

To learn more about how you can setup your sales tax, claim exemptions, and view reporting, visit our sales tax support page.

How Much Is My Sales Tax?

We maintain a public taxability matrix so you can verify which states are Marketplace states and see what items are taxable in those states. These rules are applied automatically, but the matrix allows you to better understand what taxes are being collected.

There are several features that determine the taxability of specific tickets and items that you may sell. The data that we use to determine the taxability of each purchase includes:

- Item definition: The type of item, I.E., ticket purchase, shirt, pre-purchased food item, etc.

- Item location taxability: The location used to determine taxability. For example with a ticket purchase, the location taxability is the location of the event. If a shirt is shipped to someone, then the shipping address is used for tax calculation. For a virtual event, taxability is the billing address of the participant.

- General taxability: Is the item taxable in that jurisdiction, and if so, what the rates are.

- General exemption: These are local exceptions to the generally accepted rule. An example is that the law seems to read that race registration is taxable in Texas, however one of our customers provided documentation from the state tax department clarifying that races are indeed exempt.

- Customer exemption: There are typically exemptions for nonprofits in certain states, accompanied by documentation or proof of exempt status. Non-profit exemptions for purchasing items don’t count when you are the seller of tickets or merchandise for your event. Many states also exempt non-profit sellers, but not all. We keep track of all that with our sales tax system.

What About Amusement Tax?

Amusement tax is a type of tax that some states may impose on events in lieu of or in addition to sales tax. Amusement taxes are not covered by marketplace facilitator laws in most locations*, so Avalera does not have the rules that we can call to automatically calculate and collect sales tax, and TicketSignup has no obligation to remit on behalf of events.

If your event needs to collect amusement tax on ticket sales, this can easily be handled by extra fees as explained by the link below. We can also build custom amusement tax rules for your events, although you will need to remit.

*There are some exceptions. For example, Chicago and Cook County, IL have passed marketplace facilitator laws to include amusement tax, meaning TicketSignup automatically calculates, collects, and remits amusement tax for those jurisdictions.

All the Latest Blogs on Sales Tax

Change in Wisconsin Sales Tax for Non-Profits

Recently we heard from the Wisconsin Department of Revenue that it was not appropriate for TicketSignup to allow an exemption from sales tax for nonprofit organizations (including government entities). They provided a Wisconsin Department of Revenue Marketplace Provider Common Questions guide. Item 20…

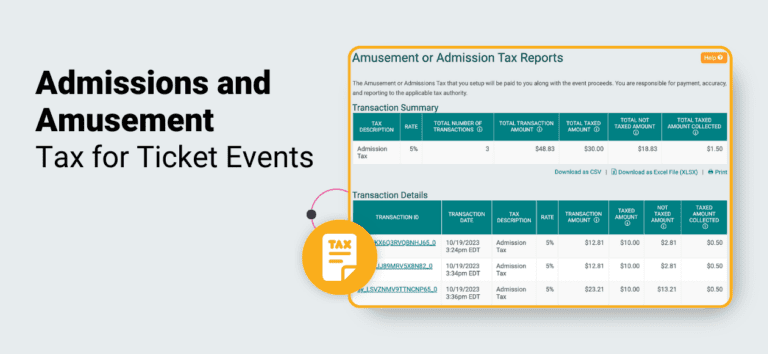

Read MoreAdmissions and Amusement Tax for Ticket Events

Selling tickets online with TicketSignup can alleviate the burden of calculating, collecting, filing, and remitting sales tax payments for ticket events, as well as ensure compliance with complex sales tax laws. TicketSignup collects and makes payments for sales tax in all marketplace…

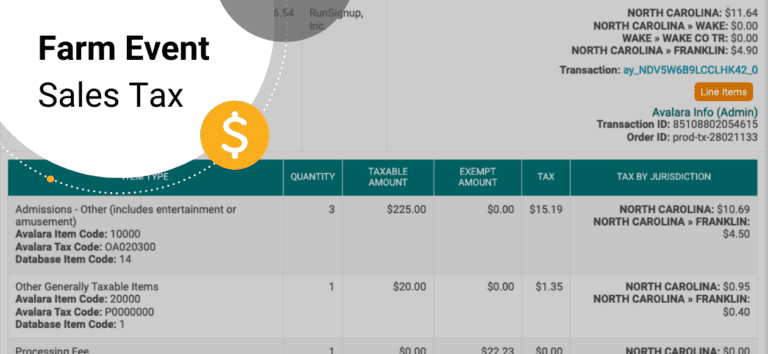

Read MoreFarm Event Sales Tax

Farms that have events like sunflower festivals, haunts, fall fests, and corn mazes may need to collect sales tax on tickets, merchandise, and other items sold. Selling tickets online with TicketSignup can alleviate the burden of calculating, collecting, filing, and remitting sales…

Read MoreSales Tax for Ticket Events

TicketSignup takes care of all the obligations of calculating, collecting and remitting sales tax for ticket events. This takes many hours of work, as well as fears of incorrect calculation, off of event operators. All ticket vendors are obligated to provide this…

Read MoreSales Tax for Tickets

We have extended our Sales Tax automation that we have had on RunSignup to all Ticket Events. We collect sales tax for all 45 states that charge sales taxes, and make payments for the taxes on behalf of events. This means events…

Read More