Farms that have events like sunflower festivals, haunts, fall fests, and corn mazes may need to collect sales tax on tickets, merchandise, and other items sold. Selling tickets online with TicketSignup can alleviate the burden of calculating, collecting, filing, and remitting sales tax payments for farm events, as well as ensuring compliance with complex sales tax laws. TicketSignup collects and makes payments for sales tax for all marketplace states.

This blog covers some of the most frequently asked questions about sales tax for farm events.

- Why does TicketSignup take responsibility for collecting and remitting sales tax for farm events?

- For what states and jurisdictions does TicketSignup collect and remit taxes?

- How does TicketSignup calculate sales tax?

- What happens if I get audited?

- What’s the difference between sales tax and amusement tax?

- How do I collect and remit amusement tax?

- Do I need to pay sales and/or amusement tax for my farm events?

Why does TicketSignup take responsibility for collecting and remitting sales tax for farm events?

States began to pass marketplace facilitator laws in 2019 and as of January 1, 2023, every state with a general sales tax also has a marketplace facilitator law. These laws shift the obligation to collect and remit sales tax from the individual seller (your farm event) to the platform facilitating the sale (TicketSignup).

Unlike other ticket platforms with BYO payment processing like SimpleTix, HauntPay, and TicketSpice that recommend events use extra fees to collect sales tax, TicketSignup complies with marketplace facilitator laws and eliminates the burden of filing and remitting sales tax for events.

For what states and jurisdictions does TicketSignup collect and remit taxes?

TicketSignup maintains a public taxability matrix that shows a high level view of potentially applicable sales tax rules by state.

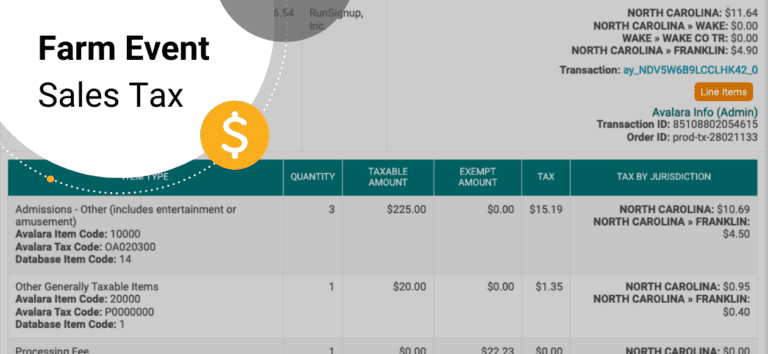

There are more than 9,000 sales tax jurisdictions in the United States, meaning sales tax calculations are incredibly nuanced. For example, the line item breakdown of the purchase below shows that there are sales taxes collected and remitted to both the state of North Carolina and Franklin County for the three tickets purchased. There is also a state and county tax for the store item. Because the person purchased their tickets from a state where processing fees are not taxable, there is no sales tax charge on the fees.

The complexity of sales tax jurisdictions makes extra fees insufficient for sales tax. TicketSignup ensures events stay in compliance without any effort.

How does TicketSignup calculate sales tax?

We partnered with Avalara as our Sales Tax provider. They have an API that we call to get rates that we can apply to tickets and items that your farm event sells. We also record those sales tax payments and for marketplace states, we rely on them to do the filing.

We break a transaction into individual line items and determine the taxability and what the tax should be. There are a number of elements to this:

- Item definition – is it a ticket purchase, a shirt, a pre-purchased food item, etc.

- Item location taxability – for example a race registration is the location of the race. If a shirt is shipped to someone, then the shipping address is used for tax calculation. For a virtual run taxability is the billing address of the participant.

- General taxability of the item in that jurisdiction, as well as rates.

- General exemptions for localities that are exceptions to the generally accepted rule. An example is that the law seems to read that race registration is taxable in Texas, however one of our customers provided documentation from the state tax department clarifying that races are indeed exempt.

- Customer Exemption. There are typically exemptions for nonprofits in certain states, accompanied by documentation or proof of exempt status. Non-profit exemptions for purchasing items don’t count when you are the seller of tickets or merchandise for your event. Many states also exempt non-profit sellers, but not all. We keep track of all that with our sales tax system.

Since this list gets multiplied by the nuances of 9,000+ jurisdictions, and the unique set of offerings from the more than 28,000 customers who rely on us, we had to develop a flexible, scalable and reliable sales tax system.

What happens if I get audited?

If your farm gets audited, you will be able to easily export summary and line item reports from your TicketSignup Dashboard to show the sales tax collected and remitted on behalf of your event. Navigate to Financial >> Sales Tax >> Sales Tax Reports.

The Summary Report shows a summary by state and jurisdiction of the total sales tax amounts collected and remitted. In addition to the sales tax collected and remitted in NJ in the example below, more than 250 jurisdictions had sales tax calculated (although many with exempt status, so fewer jurisdictions with sales tax collected and remitted). You can use the search filters to narrow in on a specific time period if some transactions are outside of the periods being audited. There is an easy export option to make it simple to share the summary report with auditors. State auditors should be familiar with marketplace rules and you can let them know that we filed and paid for the sales tax on your behalf.

The Transactions Report shows a breakdown by transaction, with details on each line item available. Like the summary report, you can search on dates and export the report.

What’s the difference between sales tax and amusement tax?

Sales tax and amusement taxes are different taxes that states may impose on events. Sales tax on tickets, merchandise, and fees are covered by marketplace facilitator laws as detailed here.

Some states and jurisdictions may charge an amusement tax on events in lieu of or in addition to sales tax. Amusement taxes are not covered by marketplace facilitator laws, so Avalara does not have rules that we can call to automatically calculate and collect sales tax and TicketSignup has no obligation to remit on behalf of events.

Note that there are some exceptions. Chicago and Cook County, IL have passed marketplace facilitator laws to include amusement tax. This means that TicketSignup automatically calculates, collects, and remits amusement tax for these jurisdictions because they have been added to Avalara.

How do I collect and remit amusement tax?

If your event needs to collect amusement tax on ticket sales, this can easily be handled by extra fees. Navigate to Financial >> Extra Fees. Click Add Fee. You have options to customize how the extra fee displays and how it is applied (i.e. per transaction, per ticket).

In the checkout cart, the amusement tax will display as its own line item.

You can also contact finance@ticketsignup.io with your state and jurisdiction’s amusement tax laws so that our development team can build a custom sales tax rule. While your event will still be responsible for remitting, this will enable better reporting.

Do I need to pay sales and/or amusement tax for my farm events?

You’re ultimately responsible for assessing your tax obligations in areas where you’re hosting an event. We encourage you to consult a tax professional if you’re not sure what your tax obligations are. TicketSignup can’t give you tax advice.