TicketSignup takes care of all the obligations of calculating, collecting and remitting sales tax for ticket events. This takes many hours of work, as well as fears of incorrect calculation, off of event operators.

All ticket vendors are obligated to provide this service for states that require “Marketplace Facilitators” to collect and remit sales tax. Over the past several years this has spread to all 46 states plus the District of Columbia that charge sales tax (DE, MT, NH and OR are the only states that do not collect sales tax, with MS enacting their Marketplace Facilitator law effective January 1, 2023). This does not remove the obligation of an event producer to pay sales tax – states and local jurisdictions can hold both responsible for payment.

Calculating, Collecting and Paying Sales Tax Properly is Complex

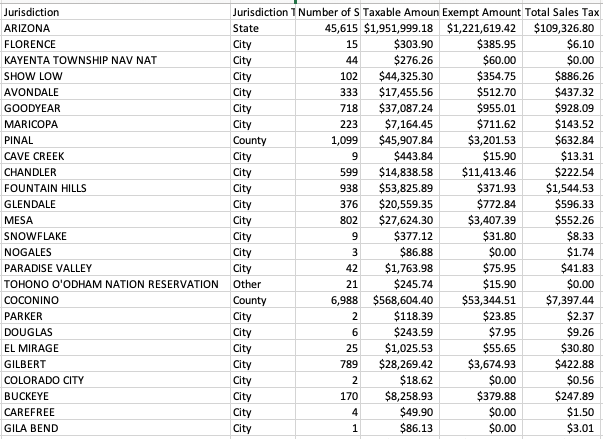

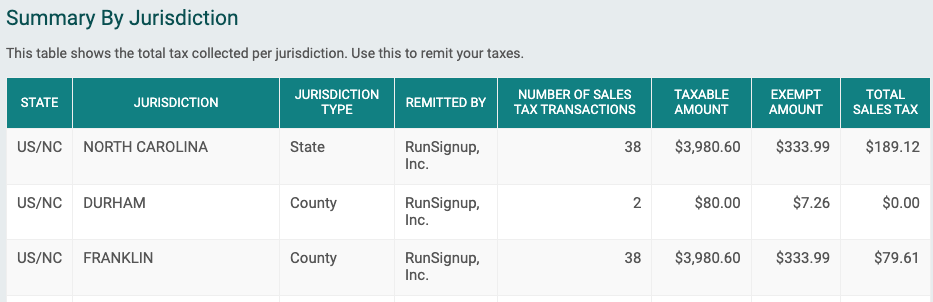

Sales tax is complex. There are actually 9,000 jurisdictions (State, County, City) who collect sales tax, with varying rules across thousands of categories. As an example, events in Phoenix, AZ need to make sales tax calculations for Arizona, Maricopa County and the City of Phoenix. As another example, in North Carolina, tax is owed to both the state and the county.

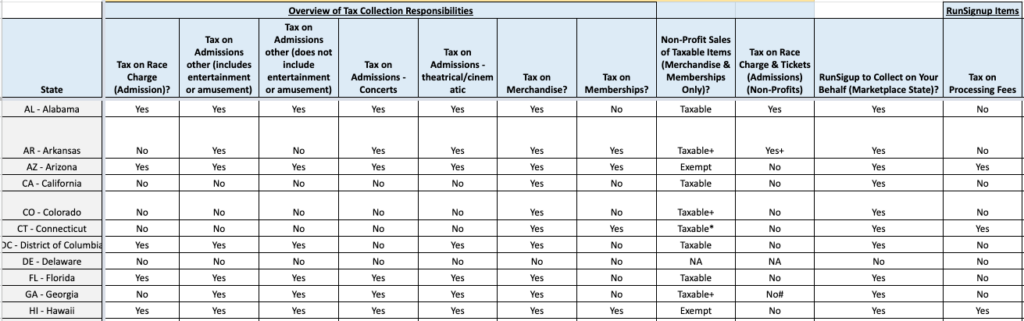

In addition, there are a number of different categories for events:

- Race/Endurance Event

- Admissions Other (includes entertainment and amusement)

- Admissions Other (does not include entertainment or amusement)

- Admissions Concerts

- Admissions Theatrical / Cinema

- Admissions / Greens Fees for public courses

- Admissions / Greens Fees for private courses

- Nonprofit Event Admissions

- Merchandise Sales

- Memberships

- Processing Fees

We have put together a handy Sales Taxability Matrix for public use. Here is a snapshot of what the matrix looks like:

Most states have monthly reporting and remittance requirements. For event producers with more than one event, this can cause additional burdens.

What TicketSignup Does to Automate Sales Tax

While many ticket vendors have done incomplete solutions for calculating sales tax, and many do not take care of collecting and remittance, TicketSignup is a complete solution provider.

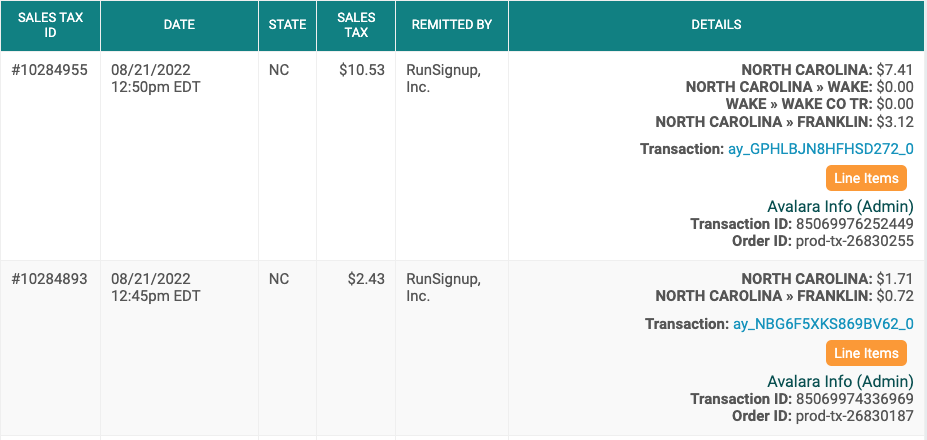

TicketSignup has made large investments in our technology stack to automate the calculation, collection and remittance of sales tax for free to all events who use us for transactions. We use Avalara as our calculation and remittance service on the back end (which costs us over $100,000 each year) calculating tax on each item within each transaction. There is complete reporting for our customers in the event they ever get audited or just want to see how much we are paying their locality.

We do all of this hard work to make sure we make things easy for our customers. Taking the load off of our tens of thousands of customers means they can focus on putting on great events and not worry about this burden. We also do it to help our customers, and quite frankly ourselves, from liability concerns. For example, if we had not collected and paid states $2.7 million so far in 2022, those states would have every right to collect that amount from us whether we had an automated sales tax feature or not.

Reporting

We provide you with Summary and Detailed transaction level reporting on sales tax:

Setup

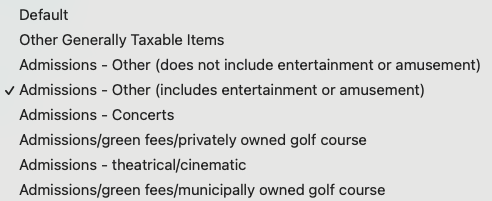

We try to assign your event and merchandise to the correct category for tax calculation purposes. In addition, we know whether each customer is a qualified nonprofit or not, since that will change the calculation in many states. Our customers can also set the sales tax category:

If you believe that your event is not taxable, then we need documentation provided by the state or municipality to that effect. You can work with your account rep, or send an email to finance@ticketsignup.io.

Summary

TicketSignup is your trusted partner in removing the time, complexity, and burden of calculating, collecting, and remitting sales tax.