For small business owners and nonprofits, credit card fees can seem like an expensive cost of doing business, with fees typically costing 1.5%-3.5% of each transaction. So the question is: how can you reduce (or eliminate) your credit card fees? There are two types of purchases that avoid these fees:

- On-site cash purchases

- Online purchases with purchasers covering all credit card and service fees

But with just 12% of transactions made in cash, it’s increasingly important to drive purchases online to limit the fees that are cutting into your margins.

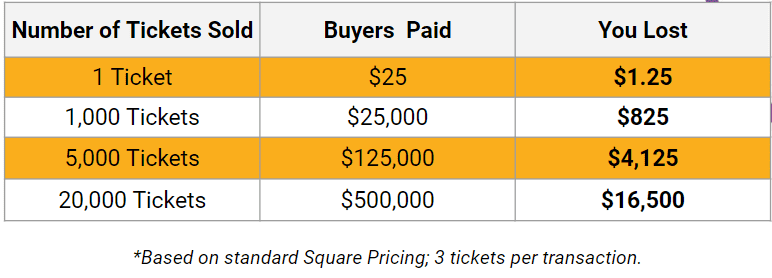

Example of How Much Credit Card Fees Can Cost You

Increasing Advanced Purchases

The first (and best) way to stop paying credit card fees is to increase the percentage of tickets and bookings that are made online in advance. Pre-sales also have additional benefits, including easier planning for you and less likelihood that potential attendees will change their plans. Pricing is a great way to increase the percentage of tickets that are sold in advance. A few of our favorite pricing strategies to drive earlier sales include:

- Price increases: People respond well to deadlines and an increase in price for late purchases is a great way to motivate action.

- Flash sales. Offer flash sales early in the week to lock in attendance. By encouraging purchases for a Saturday event on Monday, you ensure attendance and leave a few days for your ticket purchaser to convince their friends and family to join them.

- Limited edition VIP tickets. Creating a ticket bundle that upsells tickets with experience upgrades (like parking or skip the line) or items (like beverages or t-shirts) is always a great way to increase your per-participant revenue. But you can also activate bundles to encourage earlier buying by offering a time-limited VIP bundle that is only available for early purchasers.

Driving On-Site Sales Online

No matter how good your pricing strategies are, unless you regularly sellout you will always have some procrastinators. So how do you keep those people from racking up credit card fees that you have to pay? Encourage or require on-site sales to be made either in cash or on the attendees’ own mobile device.

- Create on-site signage with QR codes linking to your TicketSignup site. This means your attendee covers the credit card fees via the standard processing fees instead of you covering the credit card fees from a card swipe.

- Require all credit card purchases to be made via mobile device. Or, charge extra for on-site credit card swipes to encourage online purchases (and recoup the lost fees).

Credit card fees can seem inevitable, but they don’t have to be. Passing them onto your purchasers is standard online. Driving more sales online means you can stop paying credit card fees!