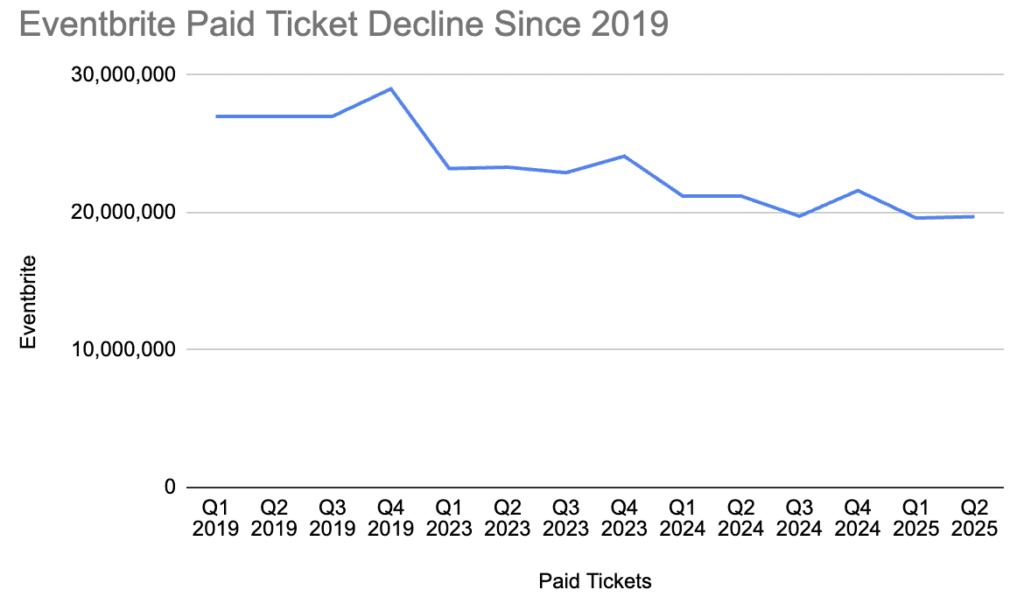

The Eventbrite Q2 2025 Earnings report was issued this past week. They showed yet another decline in paid ticket volume (down 7% from Q2 2024), but 50% growth in their ad revenue.

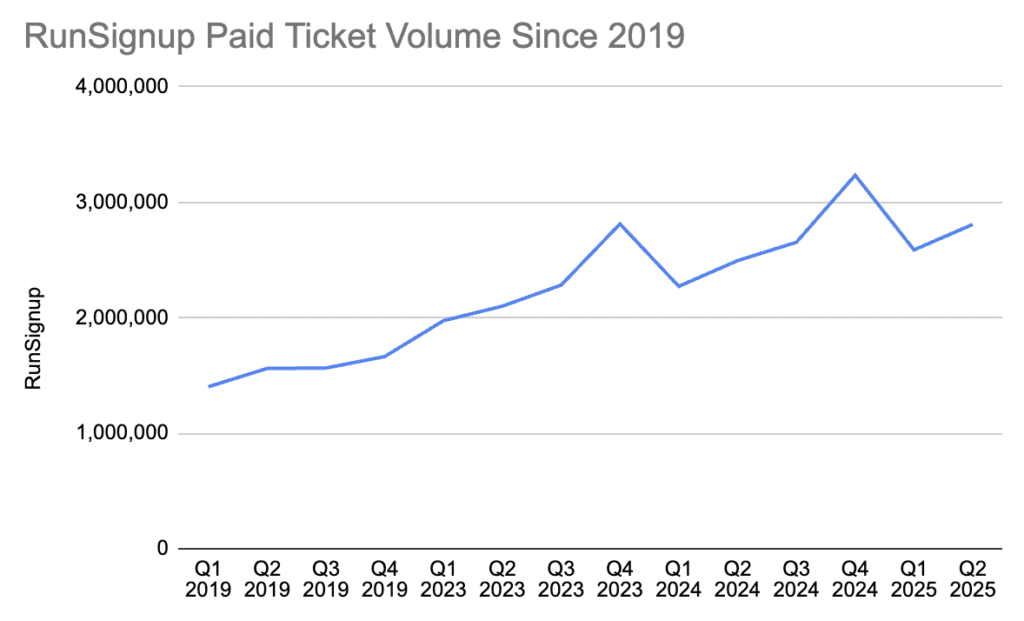

Here are two charts that show overall ticket volume at Eventbrite and RunSignup since 2019 (taking out the pandemic years):

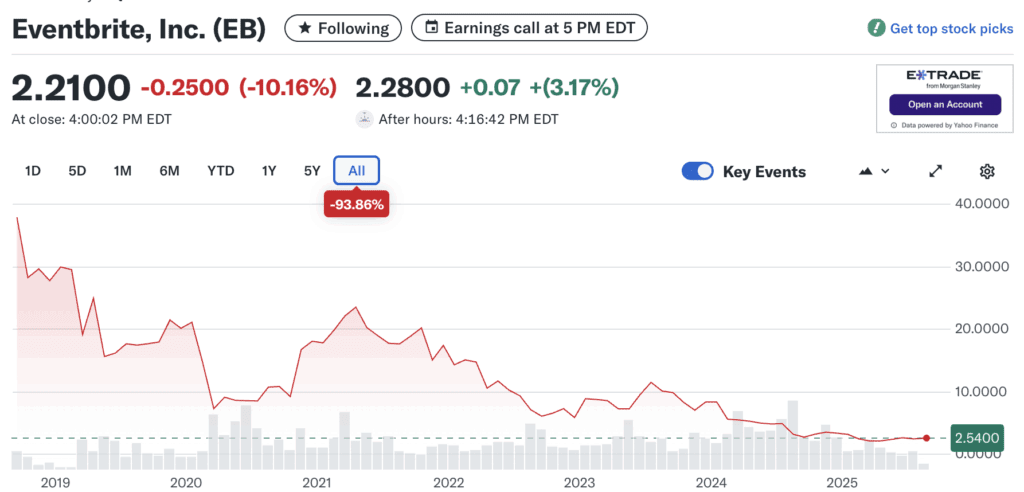

This has led to the long term decline from their IPO at $35+ to the current $2.21 per share price.

Eventbrite has signaled that the decline in ticket sales is coming to an end and they expect to have better earnings based on additional cost cuts to development, service, sales and G&A. The above chart seems to indicate the market is waiting to see if that happens.

Eventbrite Q2 2025 Earnings Report Summary

We have covered in past earnings reports several key issues in Eventbrite’s decline. It seems they have basically squandered their first mover advantage:

- Marketplace Strategy – They think they can compete with Google and Meta for ads, which is a tough hill to climb. And in doing ads for one customer, they upset other customers who also use their platform. RunSignup | TicketSignup’s white label strategy puts our customers in firm control of their own brand and eliminates conflict of interest. Looking at the charts above, customers clearly like our strategy.

- Not Profitable – At Eventbrite’s scale, they should be profitable. The past 5 years has been about multiple rounds of layoffs, losing institutional knowledge, as well as offshoring many jobs in development and customers support. Yet they remain unprofitable. RunSignup | TicketSignup is an Employee Owned company and profitable.

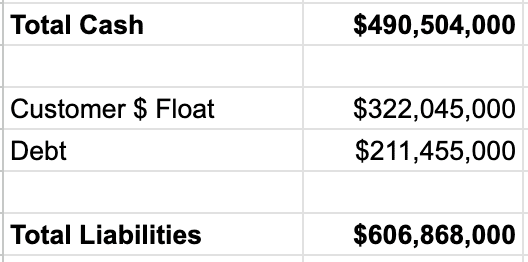

- Using Debt and Customer Cash Float – Eventbrite uses EBITDA – earning before interest and other expenses. RunSignup has no debt and does not use customer cash to finance operations – we pay out customers as they receive sales and do not wait until the end of the event.