Ticket insurance for events creates a new revenue stream by helping organizers sell tickets further in advance while giving attendees peace of mind when purchasing tickets. For events with long sales windows, premium pricing, or travel requirements, ticket insurance reduces hesitation at checkout and encourages earlier commitment. With TicketSignup your event receives 20% of the insurance premium revenue, providing an additional income stream with no added administrative work.

In one year alone, TicketSignup events sold over 300,000 insurance policies, generating $417,000 in revenue share from insurance sales and protecting $24.6 million in ticket purchases. Attendees gained peace of mind, and events earned incremental revenue without increasing ticket prices or taking on additional administrative work.

For events that sell higher-priced tickets well ahead of the event date, ticket insurance has become a proven way to drive earlier purchases, improve conversion rates, and generate predictable revenue.

Why Ticket Insurance for Events Matters for Advance Ticket Sales

Attendees hesitate most when three factors collide:

- Tickets are higher priced

- Events require long-term planning

- Purchases happen months before the event date

Travel, lodging, camping reservations, and seasonal scheduling all increase perceived risk. Ticket insurance reduces that friction by protecting buyers from covered, unforeseen circumstances that may prevent attendance.

When attendees see an affordable option to protect their purchase, they are more likely to complete the transaction instead of delaying or abandoning the sale. This effect becomes more pronounced as ticket prices rise or sales windows lengthen. Earlier commitment leads to stronger cash flow and more predictable revenue for events.

Ticket Insurance for Events as a Built-In Revenue Stream

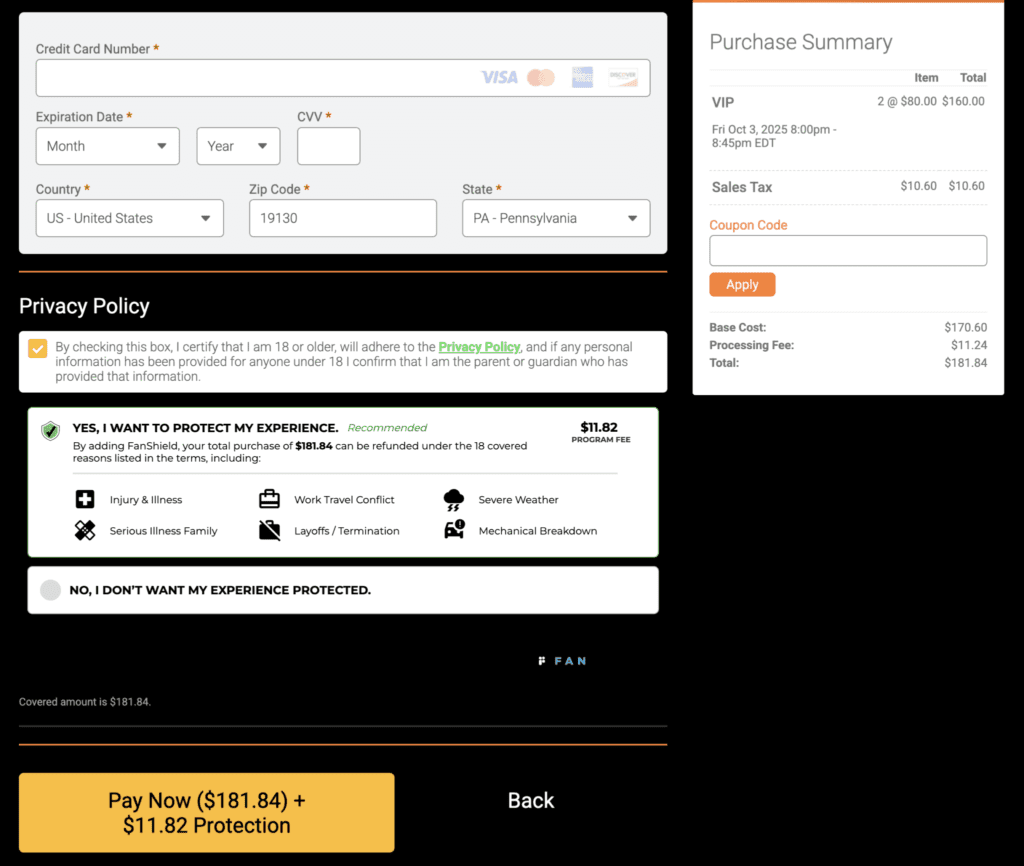

TicketSignup Insurance does more than protect attendees. With TicketSignup, your event earns revenue share on each policy sold when you enable ticket insurance. Insurance is offered as an optional add-on at checkout, with no claims processing, no customer service burden, and no changes to existing refund policies. Events earn revenue automatically when attendees choose coverage.

Many organizers use insurance revenue to:

- Create an additional refund reserve buffer

- Offset operational and marketing costs

- Generate incremental revenue without raising ticket prices

Because insurance revenue scales with ticket volume and pricing, it performs best for events that sell premium tickets or open sales far in advance.

Proven Performance: TicketSignup Insurance Results

TicketSignup insurance for events delivered strong, real-world results that validate its impact on both revenue and attendee confidence. In 2025 alone:

- 306,886 insurance policies were purchased

- $24.6 million in total coverage was provided

- $6.80 average policy cost

- $417,000 earned by events through TicketSignup’s event insurance revenue share

- 86% claim approval rate

- $490,000 paid in refunds to attendees with approved claims

These results show that ticket insurance delivers value on both sides of the transaction. Attendees trust the protection, and events benefit financially without added risk.

Where Ticket Insurance Performs Best

Ticket insurance does not benefit every ticketed event equally. While TicketSignup’s insurance offering via Teak’s Fanshield product makes policies affordable for any purchase amount with policies starting at just $2.99, lower-priced events with short sales windows typically see lower opt-in rates. However, insurance consistently performs well for events that sell tickets in advance and involve higher commitment from attendees.

Music Festivals with Camping and Travel: Music festivals selling tickets for future seasons saw strong adoption. One summer festival that launched ticket sales in December has so far seen:

- 16.7% of buyers opted into insurance

- $4,277 earned directly from insurance sales

Camping reservations, travel planning, and premium pricing increased demand for purchase protection and delivered meaningful early revenue.

Holiday Events Selling Months Ahead: A December holiday event that launched ticket sales in July provides another example of insurance driving early commitment.

- Nearly 3,000 insurance policies sold

- Ticket prices ranged from $79 to $89

- $3,505 earned from insurance revenue share

By offering protection, the event encouraged attendees to buy early while securing cash flow well ahead of peak season.

A Smarter Way to Sell Tickets in Advance

Ticket insurance for events works best as part of a broader strategy to sell tickets earlier without increasing refund risk. It gives attendees flexibility while preserving event revenue and creating a new income stream.

TicketSignup makes it easy to enable insurance, track performance, and earn revenue with no added administrative work. Learn more here.